Post summary:

We explore the business cases to finance actions beyond a company’s value chain with examples, referring, mainly, to guidance from SBTi. Indian businesses are already engaging with such actions due to regulatory and policy incentives, which could be a model for others countries/companies to emulate. The global benefit for such contributions are manifold, so can it scale?

Climate Contributions and Beyond Value Chain Mitigation (BVCM) are essentially the same and I will be using the terms interchangeably in this post.

Climate contributions or BVCM is when a company finances climate action beyond its value chain, against which the company makes no claim to offset or neutralize its own emissions. This is supposed to compliment — not replace — emission reductions to reach net zero.

Why would companies invest in climate action when they cannot claim these mitigation outcomes as part of their net zero accounting or as offsets? This question baffled me when I finished my last blog post. My first instinct was to write this idea off as complete hogwash (not the word I used in my head). I still jumped into the contributions rabbit hole to see if there is some substance to it. Here’s what I found…

BVCM according to SBTi’s guidance

The guidance document from SBTi, published in February 2024, states that BVCM can “unlock an array of opportunities, mitigate future risks and protect and enhance long-term value.” The business case would, however, depends on the company, region, business model and perceived risks. This leaves plenty of room for varied actions and strategies.

(This meant nothing — I continued reading…)

During open consultations about the idea, SBTi’s team solicited interest and reasons for such a concept from businesses themselves. More than 200 companies from a range of sectors participated through the combination of an online survey and one-to-one interviews. The reasons that came up for investing in BVCM include: demonstrating climate leadership, retaining talent, securing customers and investors, securing an advantageous position in policy scenarios, and protecting assets.

Some of these reasons piqued my interest. BVCM could protect against current/future policy directives, where companies get tax credits for investment into nature and climate (ex. provisions in The Inflation Reduction Act in the United States). Investments into nascent technology (like carbon removals) that has a future potential market can also count as BVCM, securing access to services/products that could become relevant.

The business case with examples

Reasons like retaining talent and securing customers/investors are material to companies in the Global North. Employees, customers and investors are demanding more climate action from companies in the face of rising climate disasters.

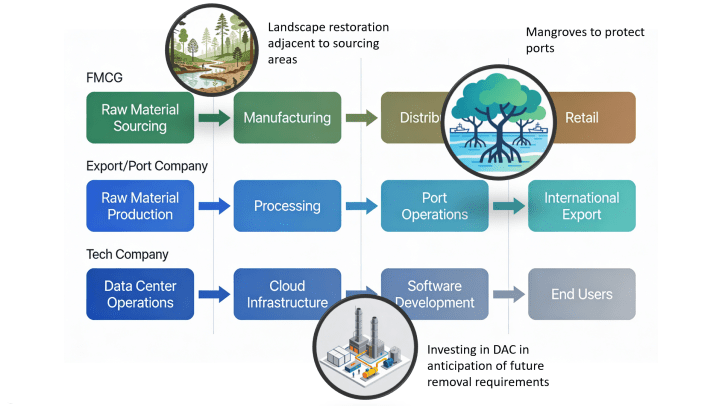

Another business case, specifically for Global North businesses, makes sense from a long-term climate strategy angle. Since many companies have taken up stricter net zero targets, they will need to start mitigating their residual emissions through carbon removals soon. The demand for removals is expected to balloon post 2030. So, they could choose to fund climate tech startups through blended finance models or research grants, anticipating that such funding can kickstart carbon removal technologies and help reach scale by the time they will need to purchase removal credits.

In the Global South, considerations around tax benefits or asset protection may be more relevant. For example, an export conglomerate could consider restoring mangroves around its major port. These mangroves can buffer the port against storm surges and cyclones, protecting business operations and assets. This investment can be communicated as a climate contribution without claiming any offsets — in fact, the revenue from carbon credits, if generated, could go to local communities living around the port.

Demonstrating climate leadership, leading to better brand differentiation and price premiums, can apply to various businesses especially if it comes with a first-mover advantage. It would also depend on their clientele’s willingness to pay premiums for climate leadership. I see B2B service companies and D2C companies benefiting from the right positioning.

Consider a B2B software company. A service offering that clubs their charges with a percentage commitment to climate contributions could be attractive clients. This is especially true if the climate contribution can be claimed by the client against their ESG reporting requirements, offering a strategic benefit. A D2C company in the luxury products segment will have a clientele that wants to affect change through their dollars — they would be willing to pay price premiums for clear communication and branding around climate contributions from their purchases.

Avoiding the offset controversy

The contributions/BVCM model also protects companies from greenwashing scandals. The NewClimate Institute’s guide on climate contributions describes the issues and risks with offsets and presents the climate contributions model as a credible alternative (since both occur outside the value chain). The same reasoning is echoed in the Net Zero Stocktake 2025.

This makes sense if you consider that not all companies need to offset residual emissions yet. Residual emissions can remain on the company’s carbon balance sheet as long as it reduces in line with their net zero trajectory. Once deep decarbonization is complete, offsets (from removals) can come into the picture for anything remaining to become “net zero”. Until then, the upside of the contributions model is compelling if it avoids the scrutiny associated with offsets in recent times.

(The NewClimate Institute’s guide also suggests using an internal carbon fee to fund such contributions. This would also incentivize faster, in-value chain reductions because it affects a company’s internal budgeting.)

Climate contributions and the Article 6 of the Paris Agreement

Climate contributions are becoming relevant in the Article 6 conversations because of complications around Corresponding Adjustments (CA). Countries may be unwilling to ‘export’ carbon credits to business buyers outside of their national boundaries to ensure that their Paris Agreement goals are met. However, businesses that have a global footprint would want to implement environmentally-positive actions in their operation sites to build goodwill and/or protect assets from climate risks. In such cases, they could fund actions under the climate contributions model — either through direct investment or by purchasing ‘contribution credits’ (which is cheaper than an offset credit because the ’emission reduction’ part is not included).

If there are business cases, are companies adopting this model?

Fewer than 12% of companies which disclosed to CDP in 2022 reported purchasing carbon credits to accelerate climate action beyond their value chains. This is, perhaps, a result of priorities.

According to SBTi guidelines, a company must first try to minimize and abate emissions within its value chain. All guidelines and best practices stress that BVCM is not a substitute for this. For now, most businesses are wrapping their heads around emissions and risks within their own value chains (Scope 3 is a nightmare). They unlikely to look beyond, unless specifically prompted to do so.

Other barriers include: fear of greenwashing accusations, no policy incentives, a financial case is not clearly established for their business/sector, no investor/customer demand. More information, from SBTi public consultations, can be found in this report.

BVCM in India: Ahead of the curve?

Under a regulatory mandate, companies are required to invest 2% of their after-tax profits into positive social and environmental actions that are not directly relevant to their business. Further, the government has come up with a Green Credits Program to encourage businesses to purchase credits and claim contributions to environmentally-positive, “green” actions like recycling, water conservation, afforestation and restoration.

The regulatory requirement and policy program promote BVCM. These are examples of policy incentives for BVCM, addressing barriers mentioned by businesses in SBTi’s public consultations. In this regard, the Indian context are ahead of the curve. Businesses could consider reporting their CSR actions and green credit purchases (once active) as BVCM, complimenting their SBTi Net Zero trajectories.

The larger benefit

My journey down this rabbit hole was surprisingly illuminating! There is certainly substance to this model. It has the potential to fill the large funding gap in climate finance. The most conservative estimate of required annual climate investment is US$ 6 trillion, according to the Landscape of Climate Finance Report 2025. This gap cannot be filled if the private sector only invests in in-value chain reductions and removals, and leave everything else to public and philanthropic actors. Sectors like nature finance and unproven climate tech are particularly cash-starved and will benefit from such financing that ask relatively less in terms of transaction costs compared to traditional offset accounting requirements.

Discover more from Eco-intelligent

Subscribe to get the latest posts sent to your email.