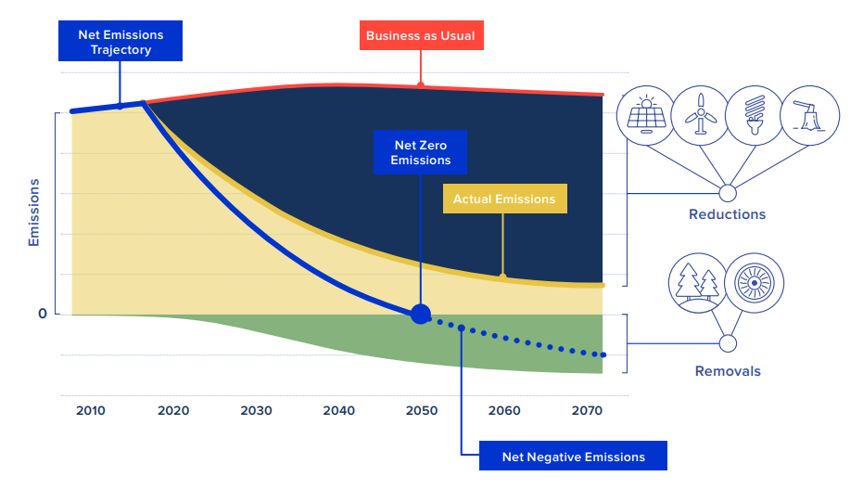

Net zero is going to require carbon removals. Our economies can never fully eliminate all emissions, because we have products like cement, steel and fertilizers whose processes will never become zero-carbon/GHG. These emissions need to be removed from the atmosphere to ensure we meet and stay at net zero global emission.

Removals, as the graph above shows, can be achieved in one of two ways — nature-based and technology based (or durable) removals. Today, nature-based removals — afforestation, reforestation, agroforestry and mangrove restoration — are economically viable and therefore, popular.

Stripe, Google, Shopify, Meta and McKinsey are betting on something more permanent and ambitious. They have founded Frontier — a pool of funds that will pre-purchase tech-based, durable carbon removals from experimental methods. Funds are injected into startups through an Advanced Market Commitment (AMC), which is expected to spur innovation and fillip a sputtering climate tech sector.

Nature-based vs tech-based Carbon Dioxide Removals (CDR)

Many companies and countries have included nature-based removals in their net zero pledges. Among companies planning to buy carbon removals, almost one-third of companies rely exclusively on nature-based approaches (Net Zero Stocktake 2025). Nature-based approaches exist today, at scale, and are relatively cheap, costing in the range of US$10-30/ton of emissions.

But nature-based removals have two problems. First, there is not enough land. A 2024 Nature Communications paper finds that existing national climate pledges (only) that rely on land‑based carbon dioxide removal (CDR) would require about 990 million hectares of additional land for removals by 2060. That is roughly the area of the US, and two-thirds of the total global cropland. If we were to scale nature-based removals to such figures, it would mean competing with agriculture, industry and housing spaces for precious land. We haven’t considered company commitments into this projection yet.

Second, nature-based removals run the risk of reversals. A forest can burn down due to forest fire. A mangrove can be destroyed in a cyclone. These land types may be converted 20-30 years in the future for some new economic interest — expanding agriculture or infrastructure. Carbon stored and paid for by companies/countries will then be released into the atmosphere.

Tech-based removals do not run the risk of reversals and are designed for long-term storage of over 1000 years — hence they also go by the term “durable removals.” Examples include enhanced weathering, biomass carbon removal and storage, and ocean alkalinity enhancement. The founding members of Frontier are betting on a nascent, but more durable or permanent solution to carbon sequestration. Frontier has a goal to buy $1B+ of permanent carbon removal by 2030. As of December 2025, it has contracted $714.8M, making it among the top three buyers of tech-based carbon removals globally.

Addressing the funding bottleneck

The constraint for durable carbon removals today is scale and cost. These technologies are new and therefore cost upwards of US$400 per ton of emissions removed. Buyers find the costs too high compared to easily available nature-based removals. They need money to invest in R&D so they can innovate and reduce unit costs. But their technology, at current stages, are too experimental for investors. The sector is stuck in a chicken-and-egg situation.

Frontier tries to tackle this problem by pre-purchasing removal credits at current, expensive, market prices. This upfront capital has given experimental ideas and startups sizable order books they can take to investors.

What if the start-up fails or does not produce as many credits as pre-purchased? Those are sunk costs for Frontier. They are entering the sector with a healthy appetite for risk, and are willing to accept that some bets will fail. Nevertheless, they have an extensive screening process before onboarding and investing in start-ups to minimize such a possibility.

Why are Frontier members agreeing to pay for expensive removal credits?

Partners within the Frontier initiative anticipate that the demand for carbon removals is going to rise in the coming decades. Once we start hitting the limits of available land, nature-based removal credits will become scarce and expensive. Durable removals based on alternative processes are essential to meet the expected demand and they want to secure their supplies to future removals, even if that means paying more now. The cost of not meeting net zero targets is perceived to be higher than spending on expensive experimental removal credits today, since these are big companies and their impact on the environment is closely scrutinized.

Such AMCs are becoming common to scale climate sectors, and show that large private actors are serious about trying to meet their climate goals.

Discover more from Eco-intelligent

Subscribe to get the latest posts sent to your email.